Hello Forex Traders, What is the difference between horizontal lines and trend lines? That was a question I recently received from a member of our trading room. It’s an excellent question and today…

Horizonal Levels - Forex Trading Strategy

Horizontal Levels is one of the simplest ideas in Forex trading and yet a very useful Forex trading strategy. Horizontal levels are fundamental in most Forex trading strategies and aid us in analy…

Forex Trading Strategies & Systems Reviews

Horizontal Line Forex Trading Strategy Leave a reply Learning how to use horizontal lines effectively in the forex market is an essential aspect of becoming a great techni…

Trading Support and Resistance Key Levels

Today’s article will focus on trading support and resistance key levels as this seems to challenge many developing traders. Learning how to trade support and resistance key levels is critical,…

Using Support and Resistance in Forex Trading

Many people disregard technical analysis as a hoax, and in some cases it can very well be. However, in Forex, technical analysis is a vital trading tool, as markets are “blind.” What’s a blind ma…

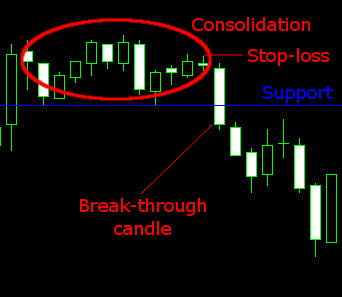

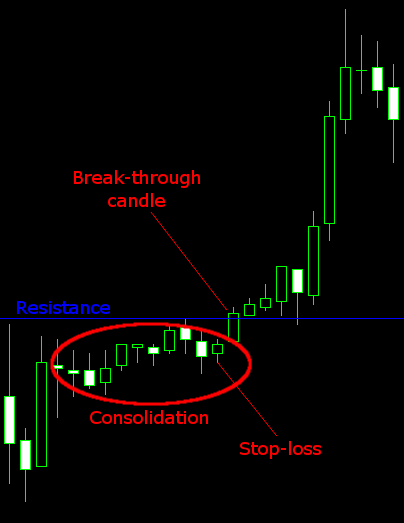

Support and Resistance Trading Strategy

Support and Resistance Forex trading strategy — is a widely used trading system based on the horizontal levels of support and resistance. These levels are formed by the candlesticks' highs and lows…

Forex Trading Strategies – Trading the False Break Part 2

Key Talking Points: False Breaks Offer Great With Trend Trade Setups Trading the False Break with Pin Bars Trading the False Break with Engulfing Bars In my prior article on trading the false break s…

Trading the False Break Strategy Part 1

Key Talking Points: False Breaks Offer Great Price Action Trading Setups You Can Trade the False Break Strategy with Pin Bars and Engulfing Bars Look for False Break Setups Trading With the Trend Eve…

The ‘False Break’ Trading Strategy

The ‘False Break’ Trading Strategy When was the last time you entered a trade and it immediately moved against you even though you felt confident the market was going to move in your favor? When…

Fakey Trading Strategy

Fakey Trading Strategy

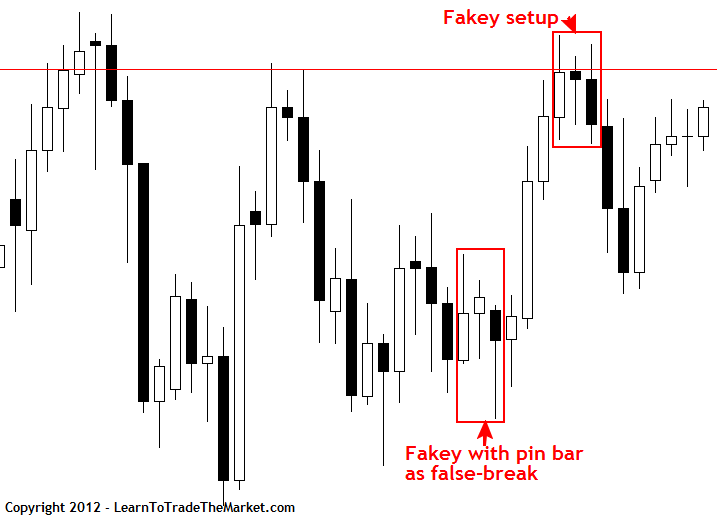

Fakey Trading StrategyThe fakey forex trading strategy was developed by a forex trader called Nial Fuller from Australia. It is a very good forex swing trading strategy which is very easy to spot on your forex charts if y…

Fakey Setup

Fakey Setup The fakey trading strategy is another bread and butter price action setup. It indicates rejection of an important level within the market. Often times the market will appear to be head…

Simple Inside Bar Forex Trading Strategy

A simple forex trading strategy to trade daily time frame's. It can be used on any currency pair and requires only 5-10 minutes of your time to check for valid trading setups. What is an inside …